Tax investigation is an unpleasant experience for a number of reasons: time, stress, and money are the first that come to mind.

Tax enquiries are often requested to be conducted with personal or telephone interviews with the individual in question or the director of the company. That’s a time consuming, stressful situation. There is so much more that can be done during that time by the business owner rather than giving an interview to the tax inspector.

We estimate that if the level of enquiries will continue rising with such speed as it is observed now, in a few years' time every taxpayer would have experience a tax investigation.

HMRC now automatically receives an unprecedented amount of data about taxpayers and businesses. It analyses the data using its CONNECT data analysis program, identifying discrepancies and cases for enquiry. HMRC has wide-reaching investigative powers and can open a variety of tax enquiries. These can be relatively simple, focusing on one or two specific issues, or be highly complex, looking at all your finances and tax affairs.

With automation of the tax services comes the downside: most of the tax officers were trained and transferred to the tax investigation department. That means that the number of tax investigations has multiplied.

Tax investigation is an unpleasant experience for a number of reasons: time, stress, and money are the first that come to mind.

Tax enquiries are often requested to be conducted with personal or telephone interviews with the individual in question or the director of the company. That’s a time consuming, stressful situation. There is so much more that can be done during that time by the business owner rather than giving an interview to the tax inspector.

We estimate that if the level of enquiries will continue rising with such speed as it is observed now, in a few years' time every taxpayer would have experience a tax investigation.

HMRC now automatically receives an unprecedented amount of data about taxpayers and businesses. It analyses the data using its CONNECT data analysis program, identifying discrepancies and cases for enquiry. HMRC has wide-reaching investigative powers and can open a variety of tax enquiries. These can be relatively simple, focusing on one or two specific issues, or be highly complex, looking at all your finances and tax affairs.

With automation of the tax services comes the downside: most of the tax officers were trained and transferred to the tax investigation department. That means that the number of tax investigations has multiplied.

Our team of experts consists ofqualified and licensed memberswith some of them beingex tax officers. The mutual team'sexperiencein tax investigation is more than140years. We are participating in the tax investigation cases on a daily basis. We are continuously reviewing tax legislation for any changes or the proposed consultations. Our team is actively participating in tax consultation and advisory meetings with the tax office.

As a team together we have over200 casesrepresenting clients in tax investigations. We have a95%success rate means that at the end of the tax investigation there wereno penalties chargedto the client.

In17%of cases, the result of the tax investigation wasnotthe extra tax to pay but a taxrefundto the business or the individual in question as an overpayment.

We work with cases of the tax rebate being delayed or postponed on a daily basis. We do it fast and swiftly so you finally get the tax rebate you are entitled to.

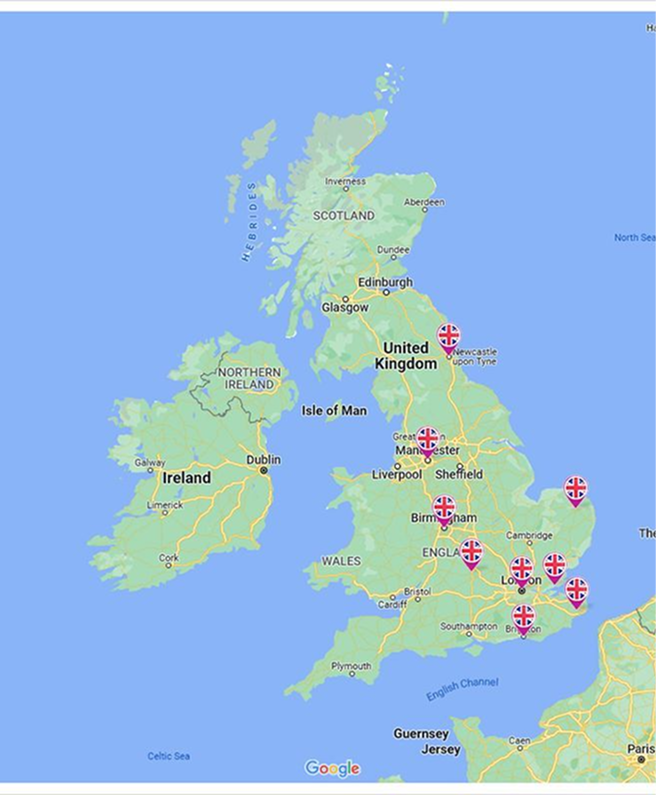

Any business or individual in the British jurisdiction is exposed to the tax enquiry. We have defended our clients in different industries: health and personal well being, entertainment and hospitality, design and construction, and landlords. There is no safe industry the taxman will miss. We worked with clients based in London, Manchester, Brighton, Kent, Southend-On-Sea, Newcastle, Norwich, Birmingham, and Oxford.

Any business or individual in the British jurisdiction is exposed to the tax enquiry. We have defended our clients in different industries: health and personal well being, entertainment and hospitality, design and construction, and landlords. There is no safe industry the taxman will miss. We worked with clients based in London, Manchester, Brighton, Kent, Southend-On-Sea, Newcastle, Norwich, Birmingham, and Oxford.

The tax office has opened an enquiry into the tax returns mainly focusing on the property portfolio. The main question was about the source of income used to acquire the properties in the portfolio which happened close to each other. The client was worried and concerned about the investigative powers and being a foreign national worried about their immigration status too. Our team has stepped in right on time taking the lead of the investigation, dealing with the requests which were within the tax office's powers only and stopped the possibility of escalating the investigation into other periods. The case was closed within 6 months resulting in the tax refund paid to the client by the tax office.